Nobody likes to save, but from time to time almost everyone has to do it. It turns out that it is not at all necessary to limit yourself to literally everything, so that you do not have to "borrow to the payday" every time.

Today we offer Top 10 Best Ways to Save Money, allowing you not to deny yourself completely in relaxation, entertainment and other familiar things.

10. Save on household energy

When planning a purchase of household appliances, you should definitely pay attention to the energy consumption class. A class A refrigerator will save a couple of thousand rubles a year in comparison with a less economical counterpart. A computer, TV, and other non-continuously used electronics should be connected through a surge protector. At the end of the work with a simple click of a button, all devices can be de-energized by going into a saving mode. Energy-saving lamps are also an affordable and effective way to reduce utility bills.

9. Save on entertainment

It’s not necessary to buy glossy magazines, DVDs and subscribe to newspapers. On the Internet, you can freely find almost any information, as well as a lot of entertaining content.

8. Save on food

There are several ways to save on nutrition. Option 1 - take lunch with you to the office from home without spending money on food in the cafe. Option 2 - buy products once a week in the wholesale market, rather than in a store near the house. Option 3 - buy food only on a full stomach, a hungry person will certainly buy a lot of unnecessary "snacks."

7. Do not borrow

The habit of borrowing sooner or later leads to a financial collapse. Purchasing the latest smartphone model on credit is certainly not the best option for those who are in saving mode. You can borrow money if the wallet remains at home and there is nothing to pay for lunch.

6. Plan

Knowing the main articles of your income and expenses is a must. Highlighting the priority payments (communal, meals, mortgages, etc.), you can calculate a more or less free balance and understand where the money goes. Sometimes a meticulous fixation of income and expenses over several months allows you to reduce your spending by 5-7 percent.

5. Divide spending into categories

Plan expenses better by category. When preparing a budget for a month, you need to plan spending on food, entertainment, clothing, loans, etc. For example, 5 thousand rubles are allocated per month for clothes. If you bought a jacket for 10 thousand, then next month we exclude such an article as clothes from the budget. It is important not to trick and transfer money between categories.

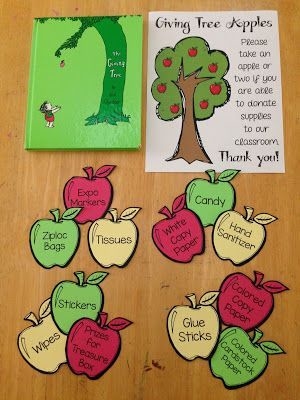

4. Ask for the necessary things as a gift

Surprises for the holidays - this, of course, is nice. But we can directly say that on my birthday I really want to get a DVR or tell everyone that the best gift is money, motivating you with a large purchase.

3. Dress up for sales

No matter how you would like to buy a new puffer jacket by the beginning of winter, it is better to wait until the sales start and get a new thing half cheaper. The economy mode is definitely not the period of life when you need to dress exclusively in branded items from the latest collections. And classic jeans bought with a big discount on sale will last more than one season.

2. Set aside for deposit

As soon as you manage to reach the next salary not at zero, but with a small balance, you should not immediately spend the money saved. From 5 to 30% of the salary, you can try to save. If the salary is transferred to a bank card, then you can issue an order at the bank to automatically transfer monthly, for example, 5% of the received amount to the deposit.

1. Follow your health

The costs of medicines, examinations, and visits to doctors can be quite a few thousand. Therefore, the right healthy lifestyle is not a luxury, but a very effective way to save money. It is not necessary to splurge on the gym, but it is necessary to walk in the fresh air. It’s not necessary to buy expensive vitamins, but you must give up smoking. Such simple rules are sure to save from significant costs.